5 Must-Know Facts About Health Insurance Benefits – Get the Most From Your Coverage

Understanding health insurance benefits is one of the most important ways to take control of your healthcare experience. Whether you’re visiting your primary care provider, a local urgent care clinic like APT Urgent Care, or an emergency room, knowing how your insurance works can save you time, money, and stress.

Here are five key areas every patient should understand about their health insurance benefits:

1. Know Your Plan Type

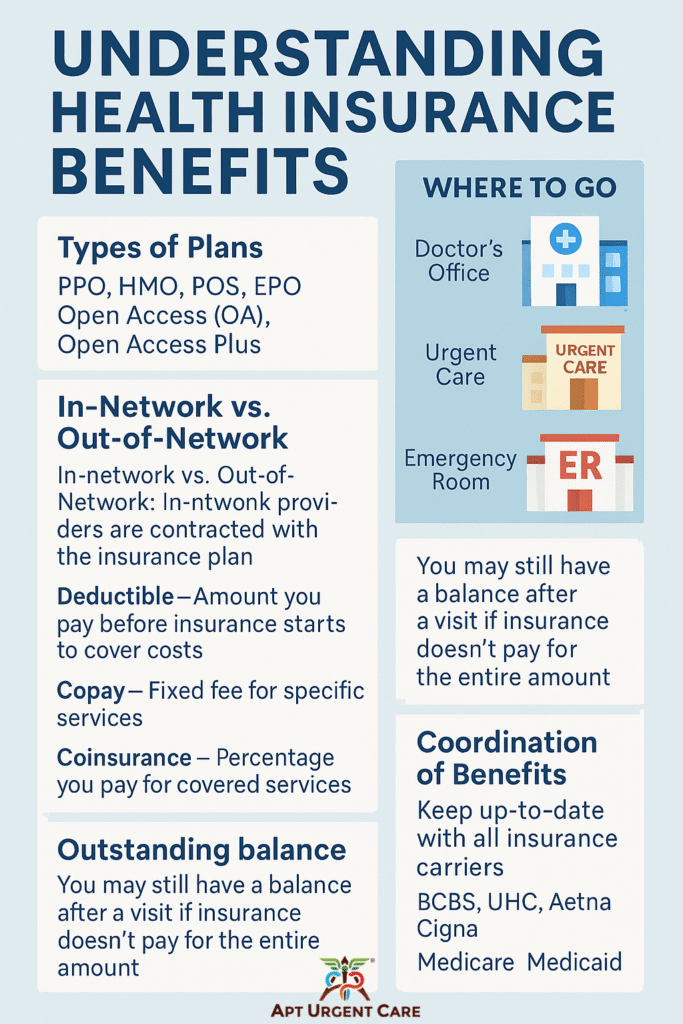

Health insurance plans are not all created equal. Here are the most common types:

- PPO (Preferred Provider Organization): Offers flexibility to visit in-network and out-of-network providers without referrals.

- HMO (Health Maintenance Organization): Typically requires referrals from a primary care physician (PCP) and limits coverage to in-network providers.

- POS (Point of Service): Hybrid between PPO and HMO; requires referrals for specialists but allows some out-of-network care.

- EPO (Exclusive Provider Organization): Covers services only from in-network providers; no referrals required.

- Open Access & Open Access Plus: Generally allow you to see specialists without referrals while maintaining network advantages.

2. In-Network vs. Out-of-Network

Your costs vary greatly depending on whether a provider is in-network (contracted with your insurance) or out-of-network (not contracted). In-network care is typically less expensive due to pre-negotiated rates. Always check the network status of a provider before your visit—especially at urgent care clinics, where network participation can vary.

3. Understand Key Cost Terms

Health insurance benefits often include several types of costs:

- Deductible: The amount you must pay out-of-pocket before insurance begins to cover services. Often split into individual and family deductibles.

- Copayment (Copay): A fixed fee for certain services, such as $25 for a primary care visit.

- Coinsurance: The percentage you pay after meeting your deductible—e.g., 20% of a covered service.

- Out-of-Pocket Maximum: The most you’ll pay in a plan year, after which your insurance covers 100% of covered services.

Even after your claim is submitted and adjudicated, you may receive a bill due to deductible gaps, copays, or coinsurance. It’s normal for there to be a balance if the insurer didn’t cover 100% of your care.

4. Coordination of Benefits (COB)

If you have more than one insurance plan (for example, through both parents or a spouse), you must keep Coordination of Benefits (COB) up to date with each insurer. COB determines which policy pays first. Failing to update COB can delay claims, result in denied services, or cause unexpected balances.

5. Understand Your Coverage Type

There are several types of insurance coverage:

- Commercial Insurance: Provided by employers or purchased individually (e.g., Blue Cross Blue Shield, Aetna, Cigna, UnitedHealthcare).

- Federal Insurance: Includes Medicare, typically for those 65+ or with disabilities.

- State Insurance: Includes Medicaid, covering eligible low-income individuals and families.

- Local Plans: Offered regionally, often through community or public programs.

Knowing your payer type helps determine coverage rules, billing, and your rights as a patient.

What to Expect at Different Healthcare Settings

- Doctor’s Office: Best for routine and follow-up care. May require referrals or have longer wait times.

- Urgent Care Clinics (like APT Urgent Care): Convenient for minor injuries, illness, and walk-ins. Usually more affordable and faster than ERs.

- Emergency Rooms: For life-threatening emergencies. Higher costs and often higher patient responsibility after insurance.

- Hospitals: Used for surgeries, specialist care, or inpatient needs. May involve multiple bills for facility, physician, and diagnostics.

Final Thoughts

Understanding your health insurance benefits is essential to avoid surprises and take full advantage of your coverage. If you’re ever unsure about your plan or how billing works at APT Urgent Care, we’re here to help clarify your benefits and verify coverage before your visit.

Click here to see what insurances we accept.

- Back-to-School Health Checklist: 9 Smart Ways to Boost Learning, Performance, and Wellness

- 5 Urgent Facts: COVID-19 Still Lurking – Recognize, Respond, and Protect

- Fuel Your Life: The Powerful Benefits of Healthy Eating & Responsible Fasting on a Budget

- Summer Camp & Sports Safety: 10 Vital Health Tips Every Parent Should Know

- Sports! 5 Essential Tips for Youth Sports Physicals – Prepare for a Winning Season